1) Qualitative Risk Assessment: The Traditional Starting Point

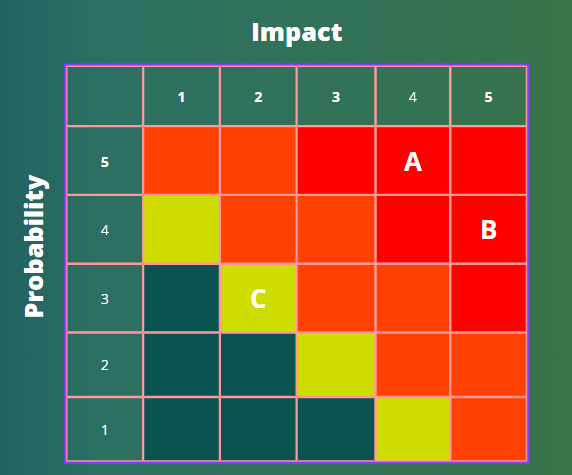

Qualitative assessment typically ranks risks on two axes: probability of occurrence and impact of occurrence

(e.g., cost, schedule, reputation, HSE, social, security). The most common tool is the Probability–Impact Matrix, or

“heat map,” which helps teams create an initial high-to-low ranking.

Strengths

- Useful for kickstarting conversations

- Surfacing obvious threats

- Organizing a preliminary risk register when data is sparse.

Limitations

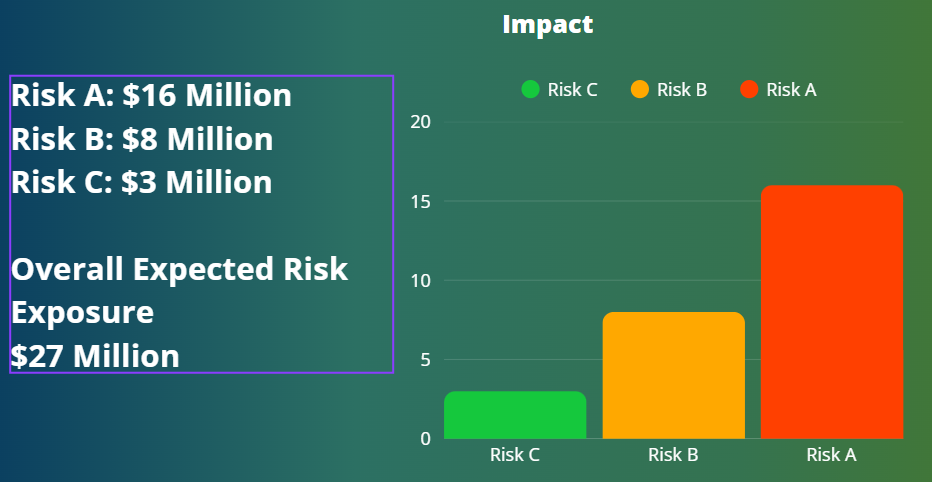

- Misleading Priorities: A 30% chance of a $10M loss can rank lower than a 60% chance of a $1M loss; priority skews toward likelihood rather than value-at-risk.

- No Aggregation: You cannot sum a heat map to answer, “What is our overall exposure?”

- Bias-Prone: Vulnerable to anchoring, optimism/pessimism, familiarity, influence, and conflicts of interest.

- Mixes Uncertainty Types: Often blends discrete risk events (may/may not happen) with business-as-usual variability (100% certain to vary), making the register hard to model.

2) Quantitative Risk Assessment (QRA): The Data-Driven Path

Quantitative Risk Assessment Key Features

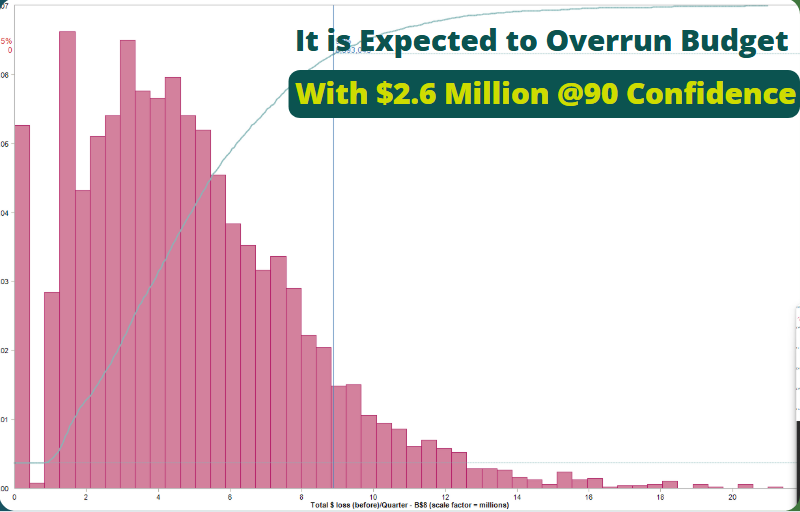

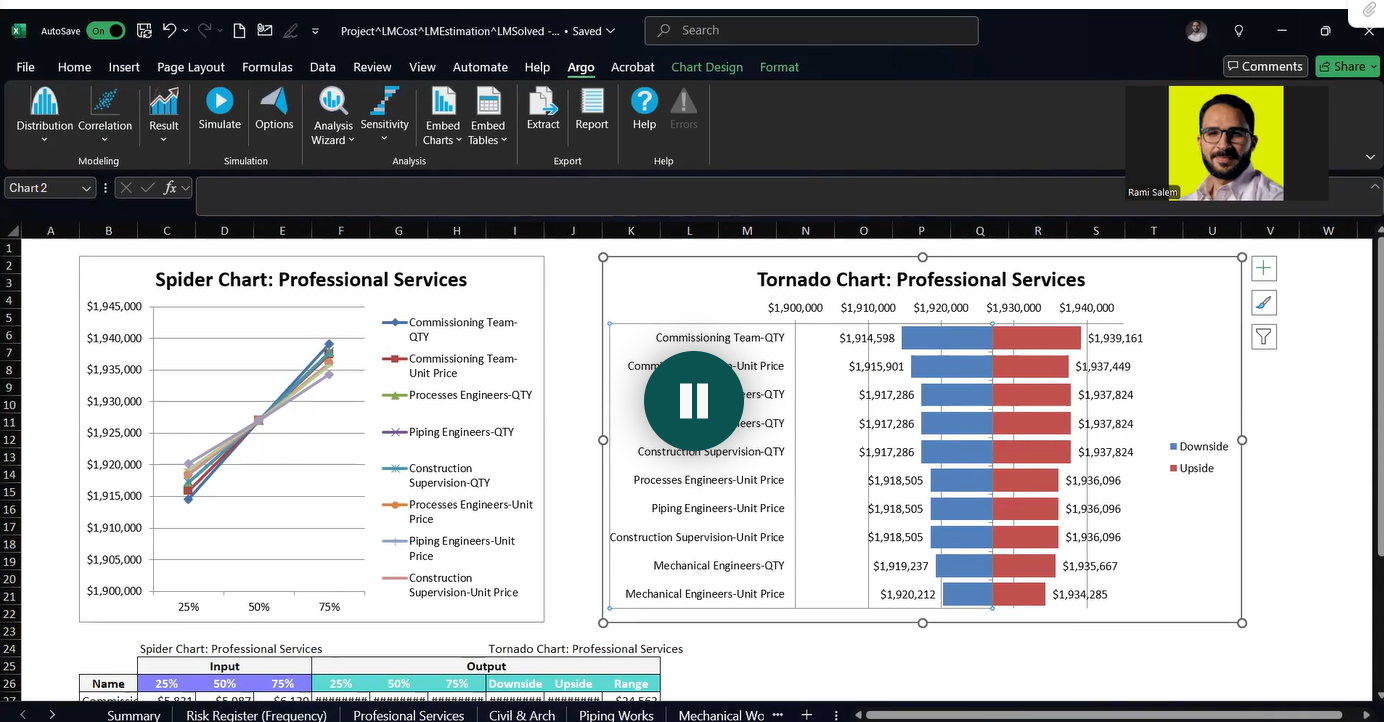

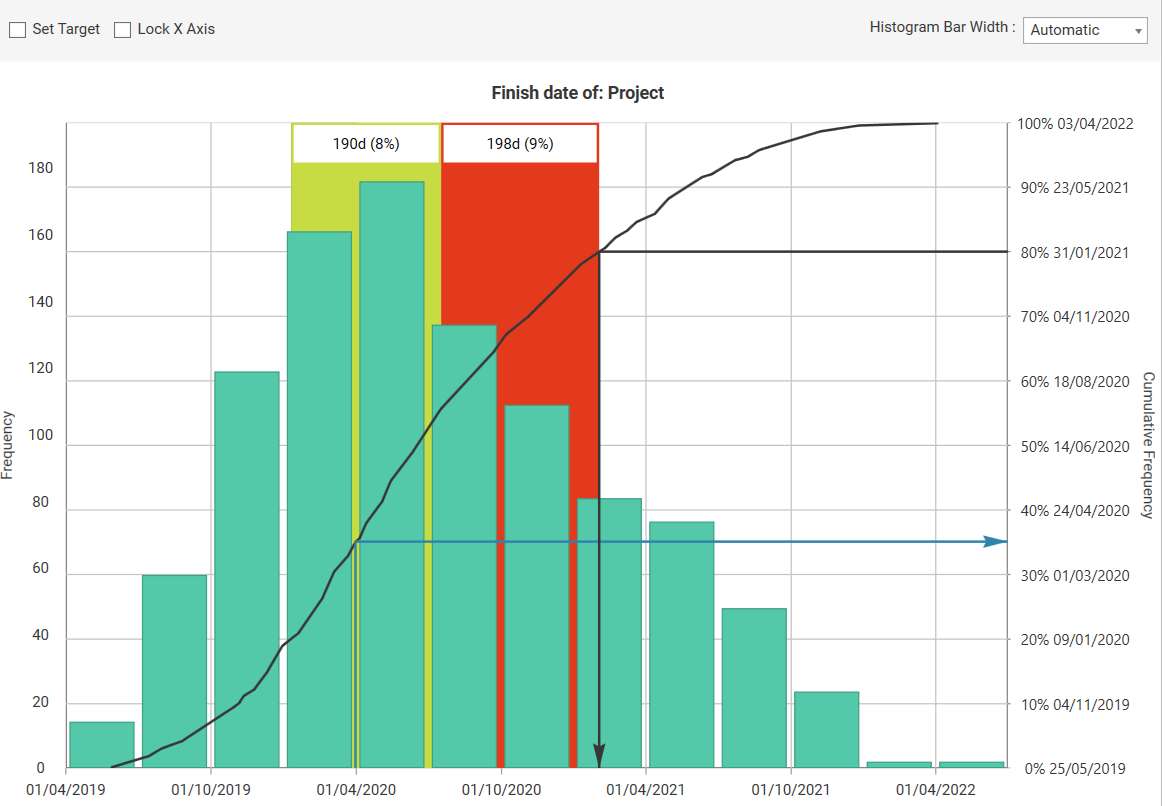

- Monte Carlo Simulation: Runs thousands of scenarios to produce distributions for total cost and completion dates.

- Clear Differentiation: Models risk events separately from business-as-usual variability for cleaner, more defensible inputs.

- Contingency with Confidence: Sets cost contingency and schedule reserve at explicit confidence levels (e.g., P70, P80).

- Aggregation: Reveals the combined exposure across all risks and uncertainties; shows which drivers dominate.

- Bias Reduction: Evidence-based inputs and repeatable methods reduce reliance on gut feel.

Why Quantitative Shift Matters

The goal of risk management is not a list; it’s clarity for action. Qualitative methods are a useful starting point, but quantitative models are essential for high-stakes decisions. With QRA, leaders see ranges instead of single numbers, allocate contingency and reserve with intent, and track how responses shift the distribution over time.

Build the Capability

If your organization is ready to move beyond heat maps to measurable, defensible decisions, consider formal training.

The Quantitative Risk Management Course (QRM Diploma)

IQRM is practice-first: define risks correctly, separate events from estimate uncertainty, build Monte Carlo models for

integrated cost and schedule, and report ranges that executives can act on.

Which assessments are you using today, and how are they shaping your contingency and reserve decisions? Share your experience.