24 Hours Training

QRM Diploma + AI

(Self-Paced)

Learn How to find Data using RDE, Build a Schedule Risk Analysis, Cost Risk Analysis and Make better decisions with Risk Management (Self-Paced Version)

Write your awesome label here.

Start your career advancement in Risk Management

Quantitative Risk Management Course and Certification (QRM Diploma + AI)

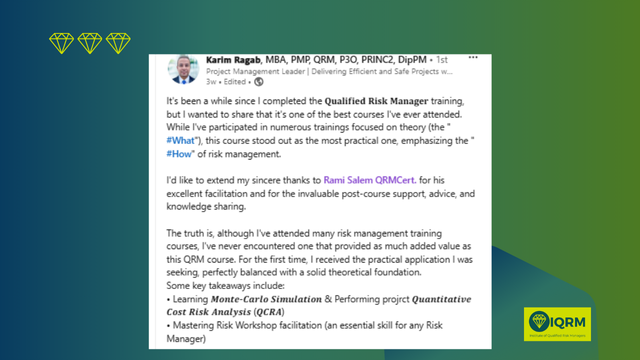

An online risk management certification that teaches Monte Carlo simulation, schedule risk analysis, and cost risk analysis—with hands-on Safran Risk training and AI accelerators.

Why this Risk Management Certification?

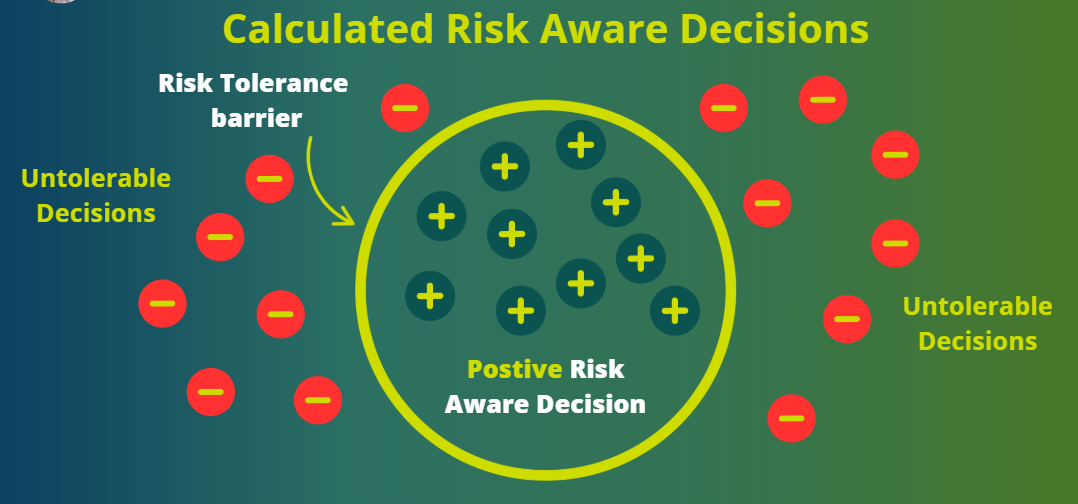

Quantification vs Heat Maps

Risk Management in 2025

Who this risk management course is for

Who this risk management course is NOT for

AI = Your Risk Assistant

Program Curriculum — Qualified Risk Manager Diploma (QRM) a Project Risk Management Course

Module 1: Monte Carlo Simulation & Probability Distributions

Module 2: Schedule Risk Analysis (QSRA) & Cost Risk Analysis and Risk Register

Module 3: From Risk Register to Decisions (Utility, JCL)

You will get access to Monte-Carlo Simulation Software

Software Access

Write your awesome label here.

ARGO

You will Get Free Access to ARGO a Monte-Carlo Software

Write your awesome label here.

Safran Risk Training License

You will get 30 Days free access to Safran Risk

Write your awesome label here.

ModelRisk Training License

You will get 14 Days Access to Model Risk an advanced Monte-Carlo Software

QRM Diploma Exam and Certificate

Rami Atef Salem

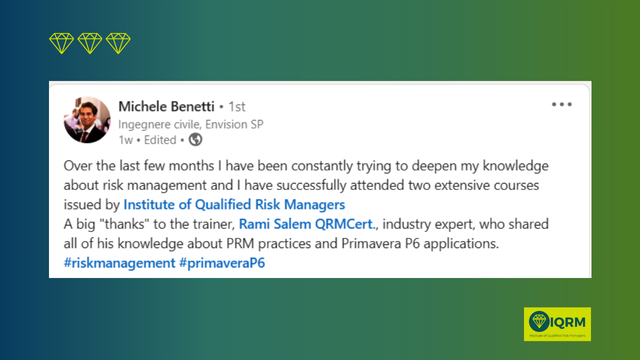

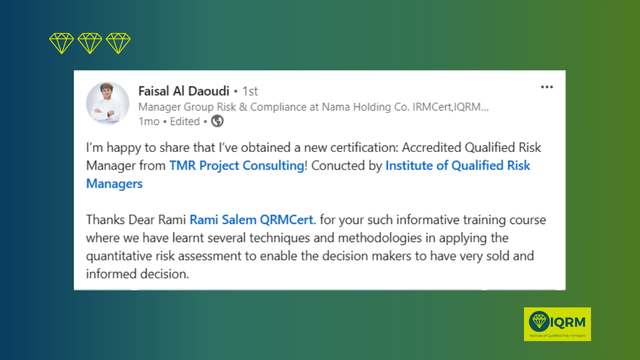

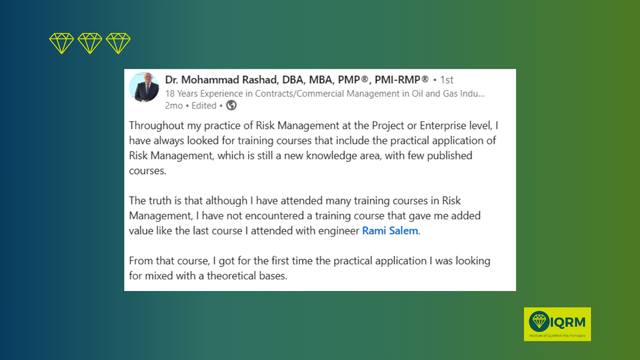

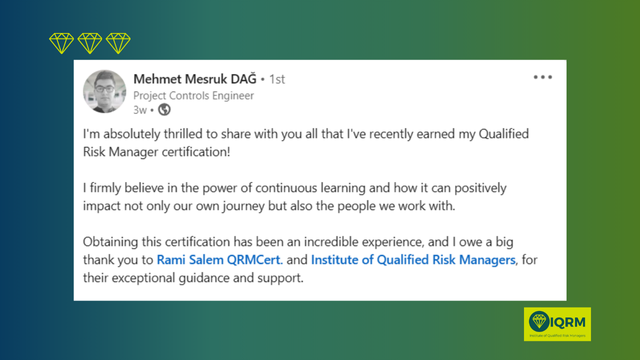

Rami is a seasoned risk management professional with 15 years of experience in the Oil and Gas industry, specializing in Quantitative Risk Assessment (QRA), decision-making models, and project risk analysis. As an expert in Safran Risk and advanced risk techniques, he has guided countless professionals in transitioning from qualitative to quantitative approaches in risk management.

Guaranteed Security using one of the most advanced encrypted systems on the market.

The information in this page is being processed and encrypted securely using industry-leading encryption and fraud prevention tools.