QRM - Quantitative Risk Management Professional Training

Include QSRA and QCRA training.

Become the Professional Who Can Independently Build QSRA & QCRA Models and Defend Risk-Based Decisions with Confidence

12 Sessions Quantitative Risk Analysis Course to independently Build your own QSRA, QCRA, and Risk-Based Decision-Making Skills

This quantitative risk analysis course is designed for professionals who want to move beyond qualitative project risk methods and become trusted quantitative decision-support experts.

If your career is reaching a ceiling because you understand project risk conceptually but cannot yet independently build and explain quantitative models, this training was designed for you.

This quantitative risk analysis course is built for project professionals working across the UK, the UAE, Saudi Arabia, and the wider GCC and globally who need practical QSRA and QCRA skills for real project decisions.

Organizations increasingly require professionals who can perform schedule risk analysis, cost risk analysis, and integrated cost and schedule risk analysis using defensible quantitative methods.

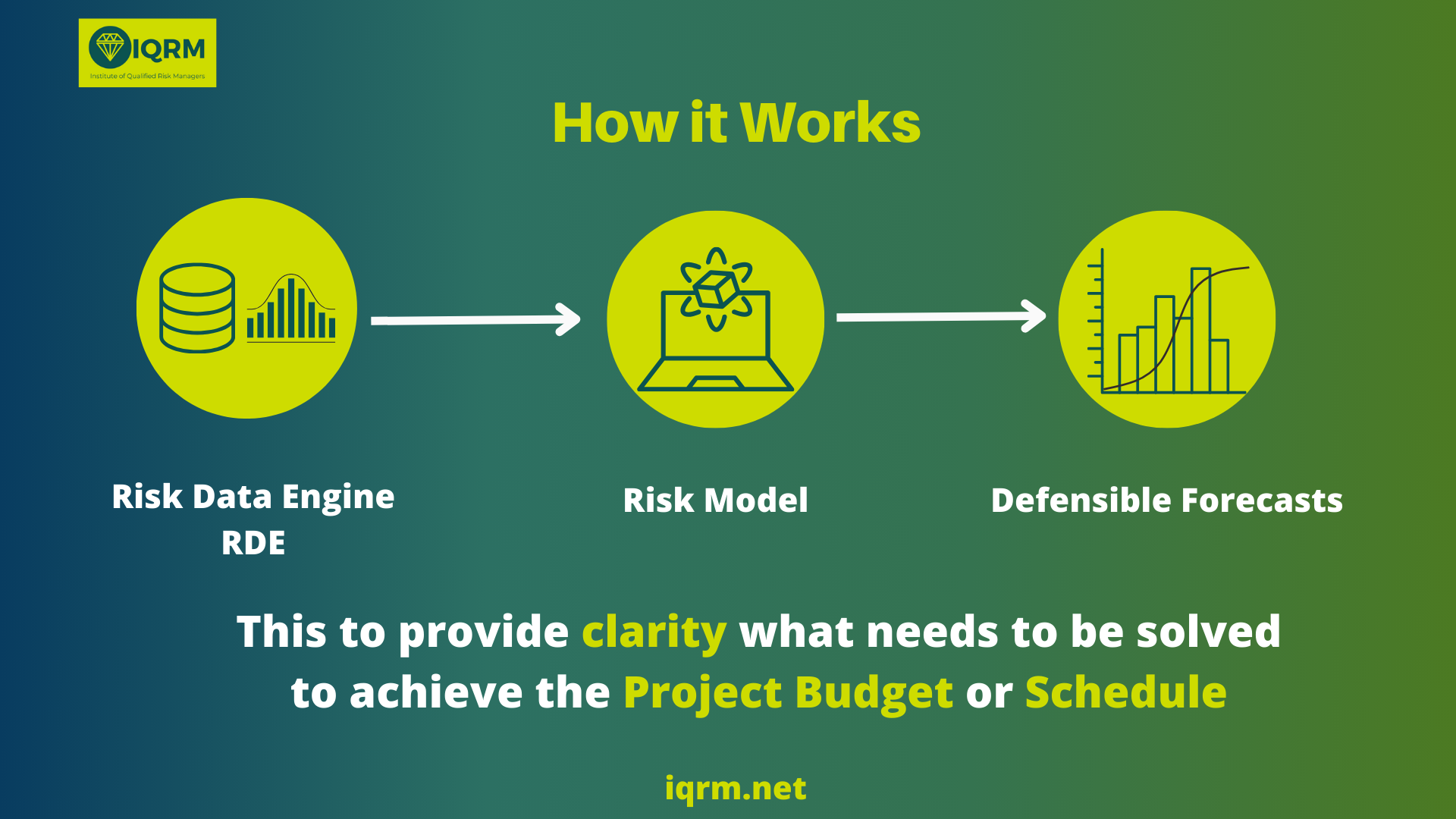

The 3 Core Components of the QRM Quantitative Risk Analysis Course

1. Quantitative Thinking & Risk Data Foundation

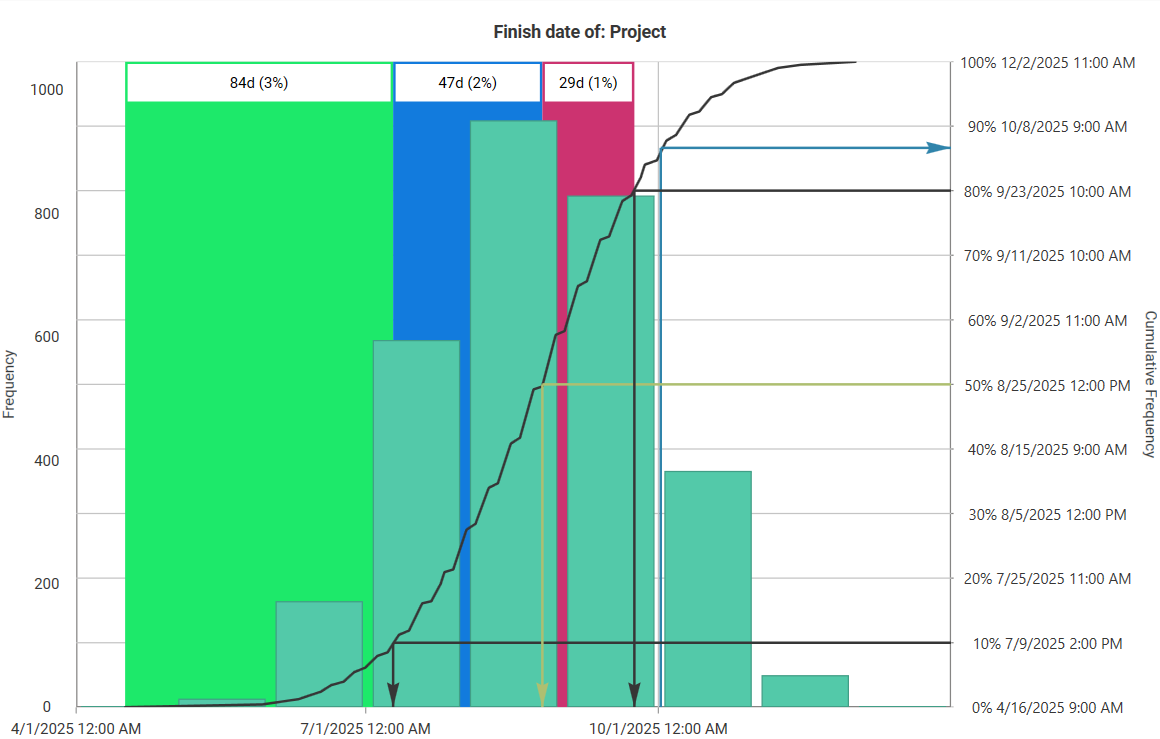

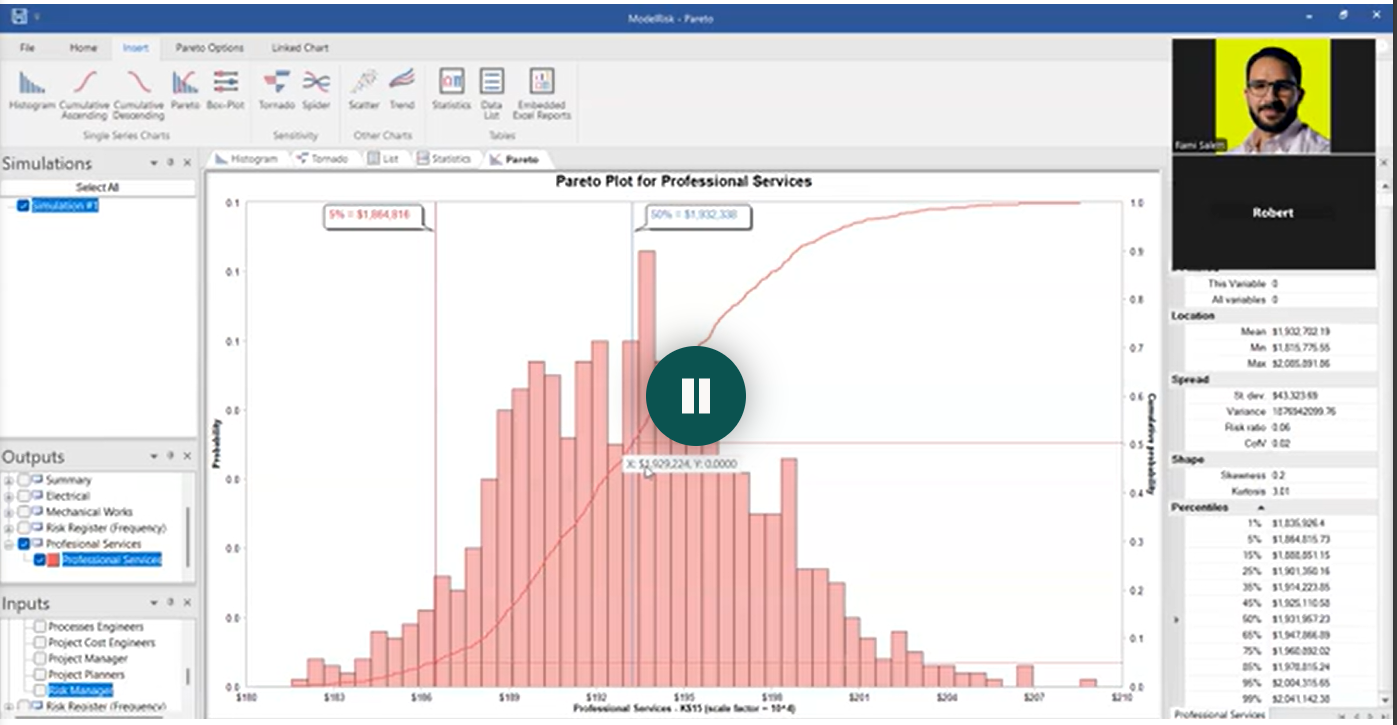

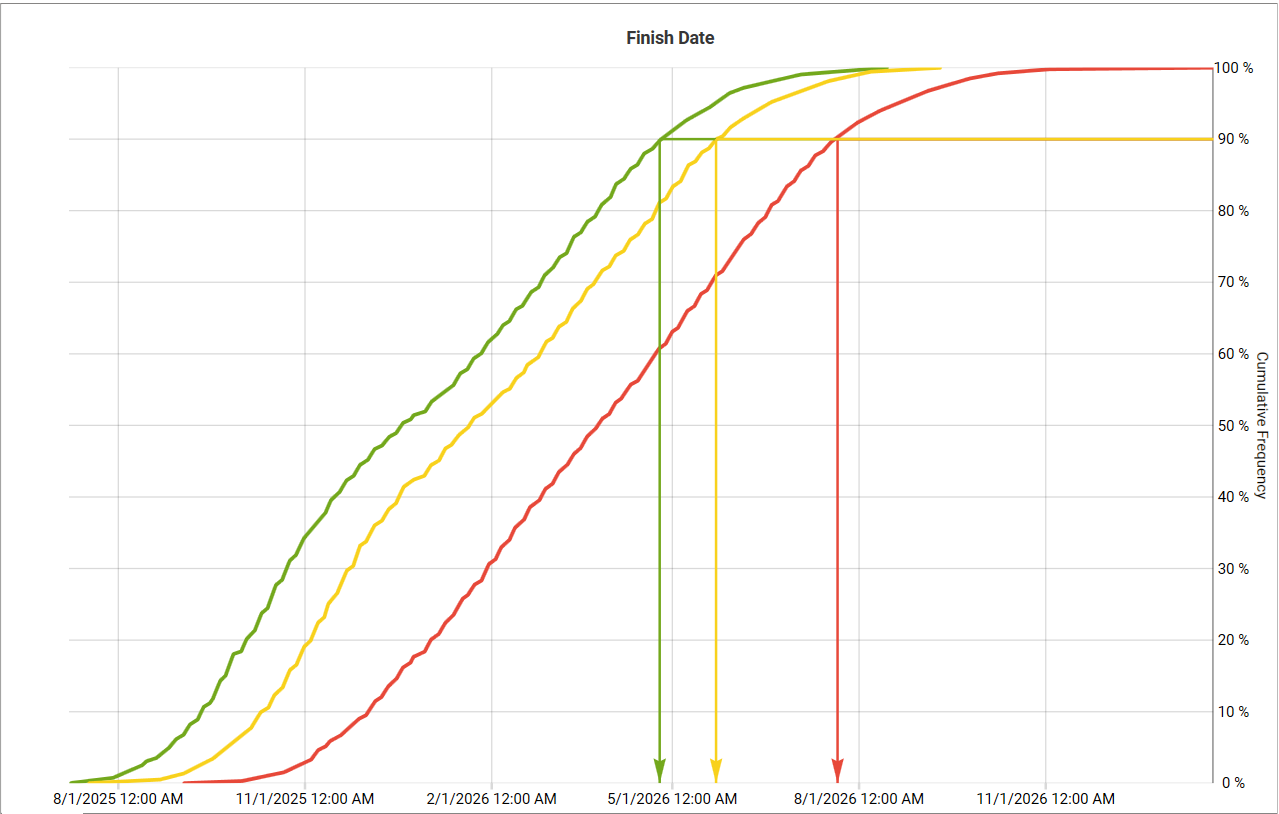

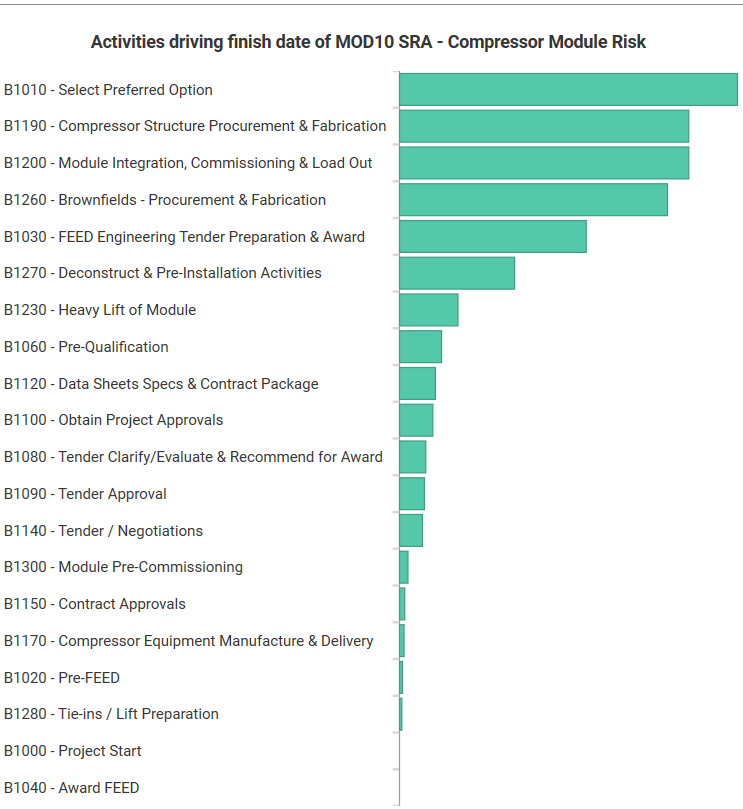

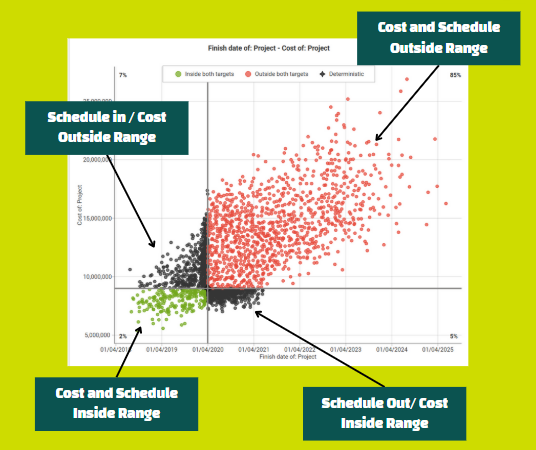

2. Quantitative Risk Modeling (QCRA, QSRA and ICSRA)

3. Risk-Based Decision Integration

Capstone Project/Case Study

The 3 Transformation Stages You’ll Go Through

1. Quantitative Thinking & Risk Data Engine (RDE) Foundations

2. Quantitative Risk Modeling (QCRA, QSRA & ICSRA)

3. Risk-Based Decision Integration

Who This Quantitative Risk Analysis Training Is (and Is Not) For

This training is for you if:

This training is NOT for you if:

QRM Quantitative Risk Analysis Course contents

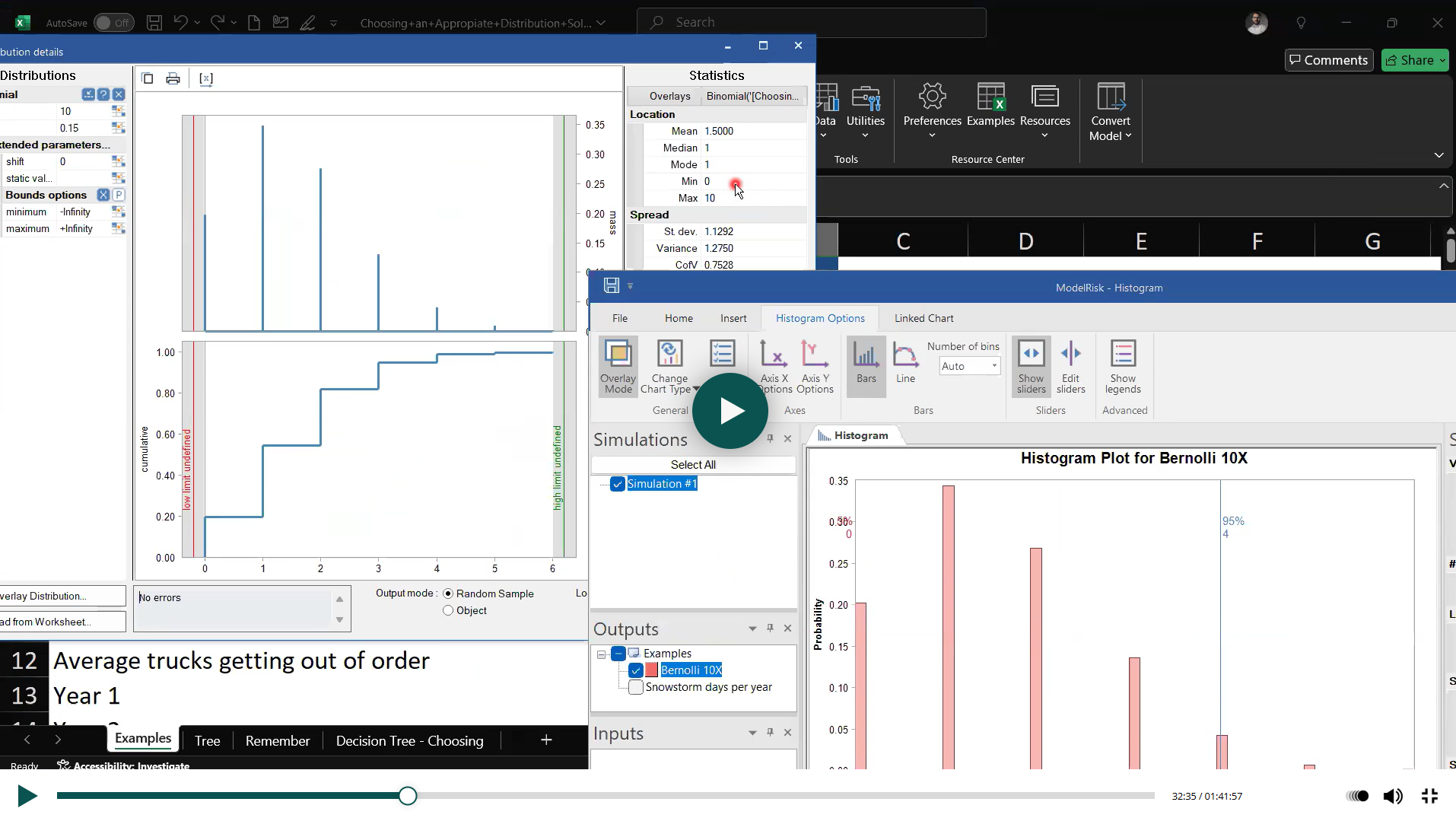

Software Access

ARGO

Safran Risk Training License

ModelRisk Training License

What you get (templates + assets you can reuse at work)

All used Schedule and Cost models

Guidebook for all practices

Quantitative Risk report template

Quantitative Risk Register Template

AI = Your Risk Assistant

Risk Data Engine GPT

Probability Distribution Selection GPT

Quantifiable Risk Statement GPT

Decision Support GPT

Quizzes, exercises, exam, certification

Rami Atef Salem

Global Experience in Risk Management and Complex Projects

Learning from someone who have doing it

Global Presence

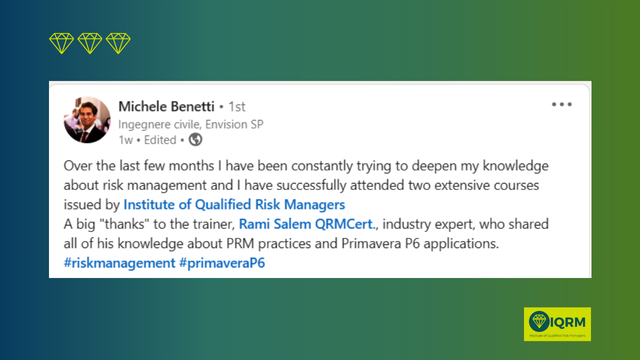

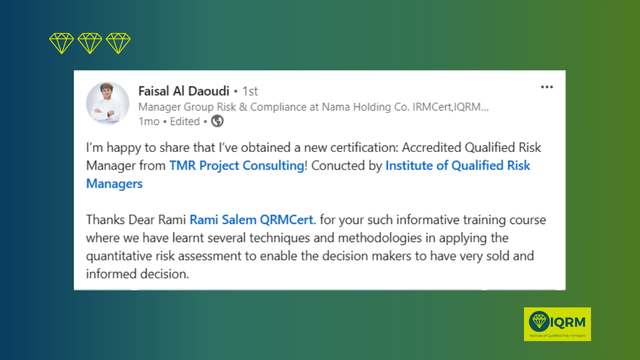

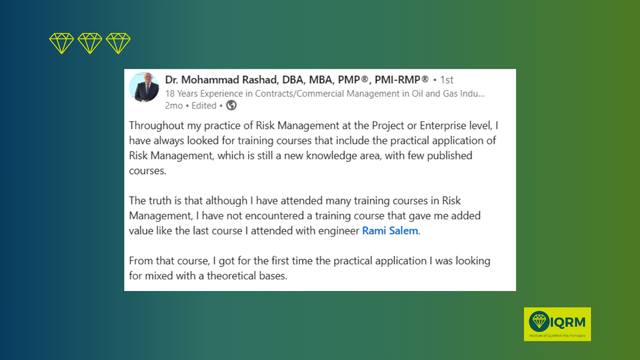

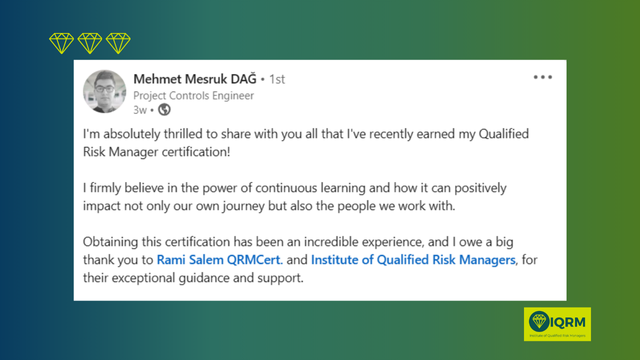

Some of the Testimonials

QRM Quantitative Risk Analysis Training

Virtual Live Session (Zoom)

(24 Contact Hours)

TBA

5:30 PM UK time all sessions

12 Students

Recordings will be availed

Other Self-Paced Options

Learn more about QSRA and QCRA

Frequently asked questions

What’s the difference between QSRA and qualitative risk reviews?

Can you work with our P6/MS Project schedules?

How many iterations do you run?

Do you integrate cost risk (JCL)?

How often should QSRA be updated?

Is IQRM a registered vendor for Saudi Aramco?

Yes — registered vendor (ID available on request). We also have hands-on delivery experience with ADNOC.